Farm Sales Tax Exemption Form Texas – In order to be exempt from sales tax, an employee must be able to make sales. This is certainly commonly completed by making marketing transactions or assisting yet another personnel close up discounts. The employee should, even so, participate in independent product sales attempts. In addition, the surface income exemption only applies to personnel who conduct business from the company’s facilities, such as at industry exhibitions. Otherwise, an outside product sales exemption file should be provided by the worker. Every time a staff member engages in outdoors income exercise, this particular type is essential. Farm Sales Tax Exemption Form Texas.

Revenue tax is just not suitable to no-income businesses.

A 501(c)(3) charity organization is normally exempt from having to pay product sales income tax, yet it is not exempt from getting or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Perceptible private property is what not-for-profit agencies can market that is taxable. Not-for-profit businesses have to match the status-particular criteria for exemption.

In order to qualify as a nonprofit, the organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity. Product sales tax exemptions for nonprofits must be wanted inside their home express and then any nearby says. Gaining income-taxes exemptions in lots of states, like together with the Efficient Product sales and Use Taxation Arrangement Certificate of Exemption, can be advantageous for not-for-profit businesses. Nonprofits should, however, constantly keep in mind the constraints positioned on sales-income tax exemptions.

Sales taxes is not placed on on the web vendors.

The majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising, according to a recent survey. These exclusions offer small, regionally owned businesses a significant benefit to allow them to contend with big countrywide merchants. The competitiveness and profitability of small enterprises will suffer if these exclusions are eliminated. Compared to large companies, little businesses are frequently far more entrepreneurial and versatile in terms of new modern technology.

In actuality, the Wayfair ruling puts a unique increased exposure of on the internet marketplaces and mandates that they can collect product sales taxation from their 3rd-bash retailers. Many on the internet merchants, which includes Amazon online, averted this require for several years before you start to charge product sales taxes to the goods and services they offer. In spite of experiencing bodily locations in some claims, Amazon . com only gathers sales taxes on the goods they offer directly to consumers. These sellers have to to carefully examine their business online strategy and make sure that the proper revenue income tax is being paid for.

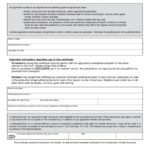

You need to distribute Form Saint-12.

When seeking a revenue tax exemption, a real qualification of exemption is needed. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A concrete personalized piece or service is reported to be in its main use when it is utilized for around 50Per cent of the time. A product sales income tax exemption qualification must be given to the owner by the shopper of an exempt great or services. The owner is responsible for offering data.

By submitting Form ST-12, a firm can request a tax exemption certificate. The seller is required to give the vendors the form in order to withdraw it if the company is no longer eligible for the sales tax exemption. The usage of exemption use accreditation is governed by Massachusetts Legislation (830 CMR 64H.8.1). Criminal consequences may apply if an exemption certificate is knowingly misused. A business could deal with the two criminal and civil penalty charges for deliberately breaking up this rule.

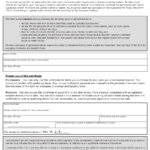

The certificate’s 5 various-season expiry day

The majority of folks are not aware that accreditations end after five years. Since they haven’t been employed within that point, they are no longer likely to be legit. If you want to continue using it, you must obtain a new one, in truth, it’s typical for a card or certificate to expire for more than ten years; therefore. The good news is that you are protected from this circumstance by the law.

When your official document is because of expire, SSL certificate providers give notifications with their distribution details. The issue is that when your certificate comes up for renewal, your Point-of-Contact might not be available. In reality, when the certification expires, you may have a campaign or get fired. Fortunately, by using these tactics, you could possibly avoid this situation. You could increase the life span of your own SSL certification with such effortless ideas.