Georgia Sales Tax Exemption Form Nonprofit – In order to be exempt from sales tax, an employee must be able to make sales. This can be commonly accomplished through making promotional transactions or aiding yet another personnel near bargains. The employee must, nonetheless, embark on independent revenue initiatives. In addition, the surface income exemption only relates to staff members who perform organization out of the company’s facilities, such as at industry exhibitions. Or else, an outside product sales exemption record has to be offered with the employee. Each time a staff member engages in exterior income exercise, this type is needed. Georgia Sales Tax Exemption Form Nonprofit.

Revenue taxes will not be relevant to non-profit agencies.

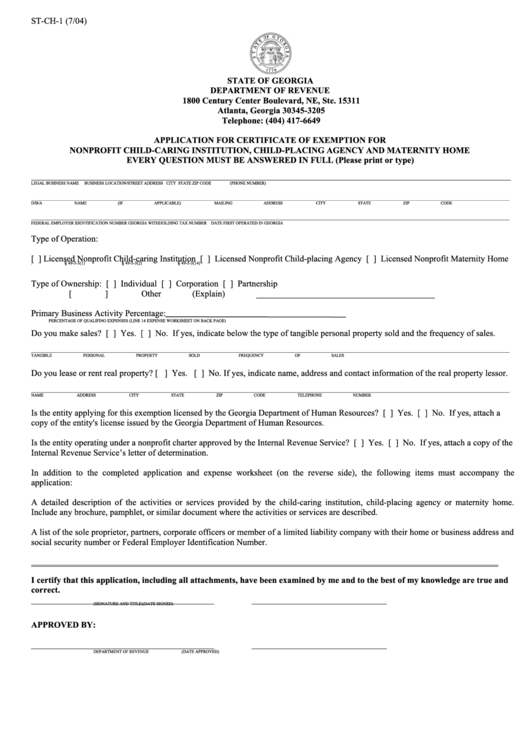

A 501(c)(3) charitable firm is typically exempt from spending revenue taxation, yet it is not exempt from accumulating or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Perceptible private residence is what not for profit companies can market that is certainly taxable. Not for profit companies have to fulfill the condition-particular requirements for exemption.

In order to qualify as a nonprofit, the organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity. Sales tax exemptions for nonprofits must be requested inside their property state as well as any nearby suggests. Achieving sales-income tax exemptions in lots of suggests, like with all the Efficient Sales and Use Taxation Contract Official document of Exemption, can also be useful for not-for-profit companies. Nonprofits must, however, constantly be familiar with the limits placed on revenue-tax exemptions.

Sales taxes is just not put on on-line vendors.

According to a recent survey, the majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising. These exclusions provide modest, locally possessed companies a significant benefit so they can contend with large nationwide shops. If these exclusions are eliminated, the competitiveness and profitability of small enterprises will suffer. In comparison to large agencies, modest enterprises are usually much more entrepreneurial and versatile in terms of new technological innovation.

In fact, the Wayfair ruling puts a special increased exposure of on-line marketplaces and mandates which they collect revenue tax off their thirdly-party retailers. A lot of on the internet vendors, which includes Amazon online marketplace, averted this need for several years before you start to cost revenue taxation for your goods and services they feature. Even with getting actual physical places in certain states, Amazon online marketplace only collects revenue income tax in the goods they offer straight to customers. These sellers need to to cautiously examine their web business technique and make sure that this appropriate income income tax is now being paid out.

You must submit Kind Saint-12.

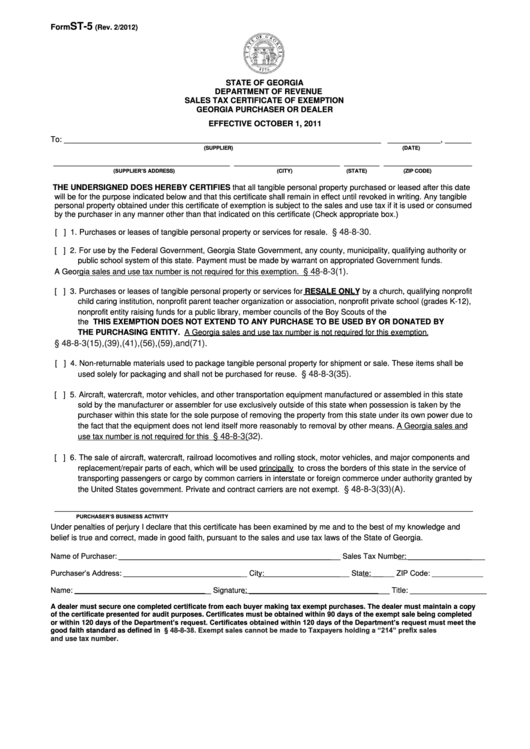

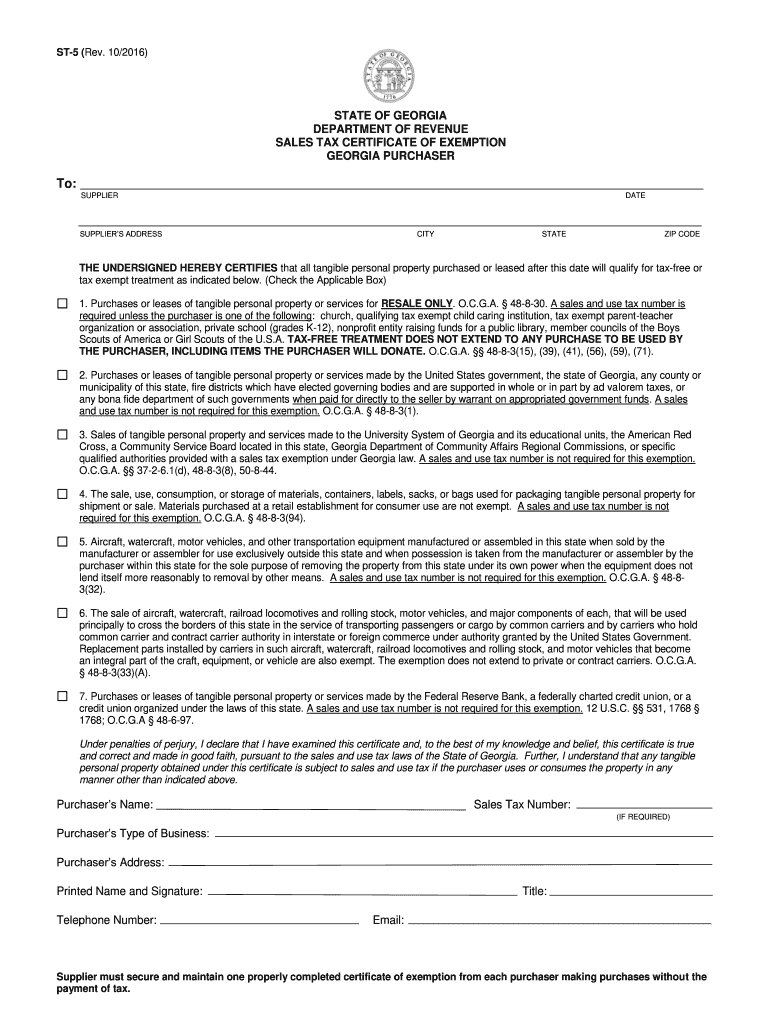

When asking for a product sales income tax exemption, a legitimate certificate of exemption is needed. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A perceptible personalized piece or services are said to be within its main use after it is utilized for about 50Percent of times. A product sales tax exemption certificate has to be offered to the seller from the buyer of your exempt excellent or assistance. The owner is mainly responsible for delivering evidence.

A firm can request a tax exemption certificate, by submitting Form ST-12. In order to withdraw it if the company is no longer eligible for the sales tax exemption, the seller is required to give the vendors the form. The utilization of exemption use accreditations is governed by Massachusetts Regulation (830 CMR 64H.8.1). If an exemption certificate is knowingly misused, criminal consequences may apply. A company could experience equally criminal and civil charges for deliberately breaking up this tip.

The certificate’s several-season expiry time

Virtually all individuals are unaware that qualifications end soon after five-years. Simply because they haven’t been utilized inside of that period, these are no more probably be legitimate. If you want to continue using it, you must obtain a new one, in truth, it’s typical for a card or certificate to expire for more than ten years; therefore. You are protected from this circumstance by the law. That’s the good news.

Whenever your certification is due to expire, SSL official document suppliers send out notifications to their submission listings. When your certificate comes up for renewal, your Point-of-Contact might not be available,. That is the issue. Actually, when the qualification comes to an end, you may have a campaign or get fired. Fortunately, by using these strategies, you may avoid this predicament. You could increase the life span of the SSL certification utilizing these simple suggestions.