Louisiana Sales Tax Exemption Form For Out Of State Company – An employee must be able to make sales in order to be exempt from sales tax. This is commonly attained if you make advertising transactions or assisting another staff near bargains. The staff member must, however, embark on independent revenue efforts. In addition, the outside product sales exemption only applies to workers who conduct company outside the company’s services, including at industry exhibitions. Otherwise, a third party income exemption file must be provided with the worker. Every time an employee engages in exterior income activity, this type is needed. Louisiana Sales Tax Exemption Form For Out Of State Company.

Income taxation is just not relevant to non-earnings businesses.

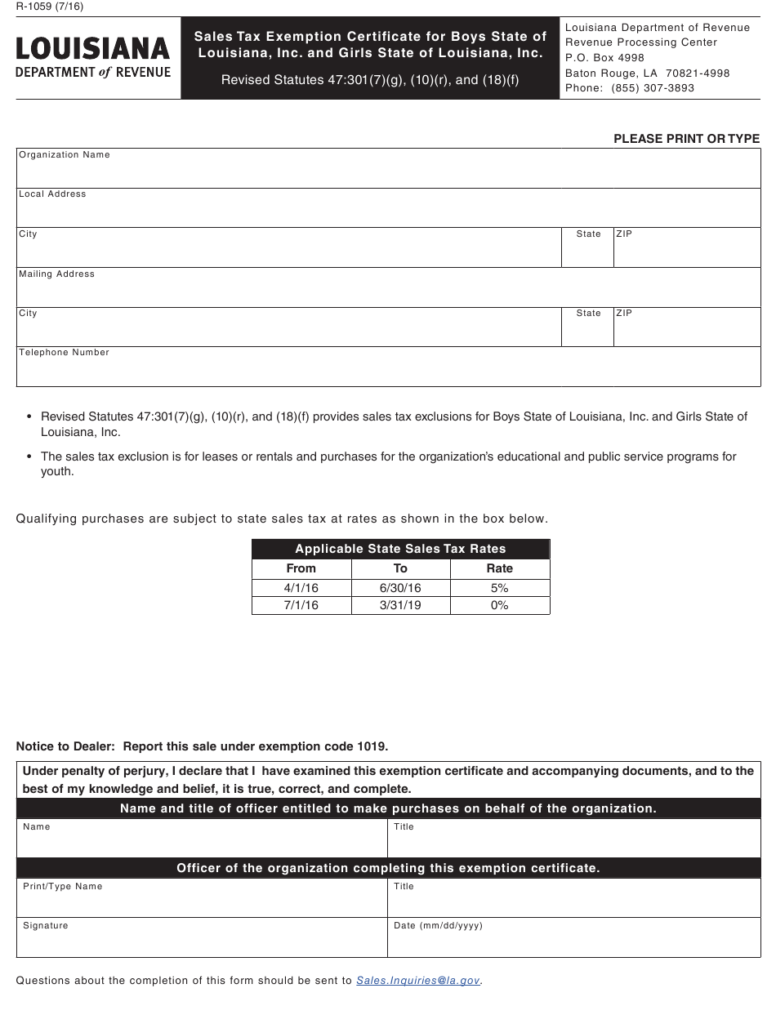

A 501(c)(3) charity firm is generally exempt from having to pay product sales tax, however it is not exempt from accumulating or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Perceptible private residence is exactly what not for profit companies can market that is taxable. Not-for-profit agencies have to match the express-specific requirements for exemption.

The organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity, in order to qualify as a nonprofit. Income tax exemptions for nonprofits should be required within their property condition and any neighboring claims. Getting revenue-taxes exemptions in many says, for example with the Sleek Income and Use Taxation Arrangement Qualification of Exemption, can be useful for not-for-profit companies. Nonprofits need to, however, constantly know about the constraints placed on revenue-tax exemptions.

Revenue taxes is not applied to on-line sellers.

According to a recent survey, the majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising. These exclusions offer small, nearby owned and operated companies an important edge so they can contend with big countrywide merchants. If these exclusions are eliminated, the profitability and competitiveness of small enterprises will suffer. In comparison to huge companies, small enterprises are usually much more entrepreneurial and versatile when it comes to new modern technology.

In actuality, the Wayfair judgment sets a unique concentrate on on-line marketplaces and mandates they acquire income income tax using their next-bash retailers. A lot of on the internet vendors, which includes Amazon online, eliminated this require for many years before you start to fee income tax for that goods and services they offer. Even with having actual places in many suggests, Amazon . com only records product sales income tax around the products they sell straight to consumers. These retailers must to carefully examine their business online method and make sure that the correct product sales tax is now being paid out.

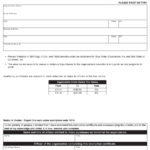

You need to send Develop Saint-12.

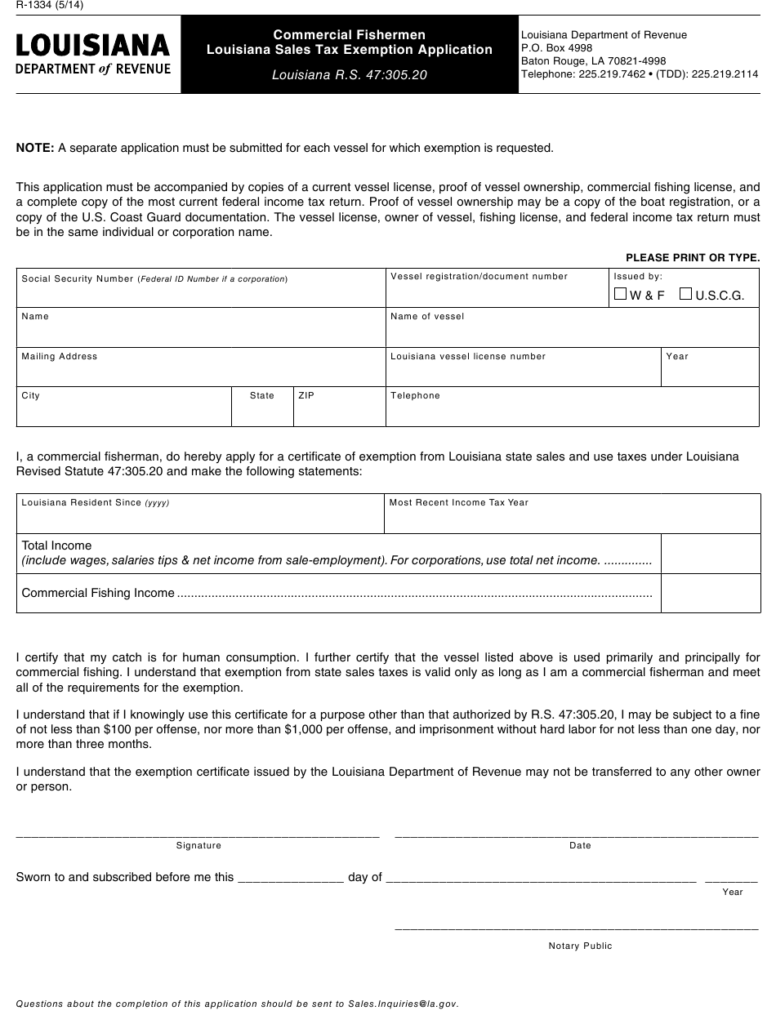

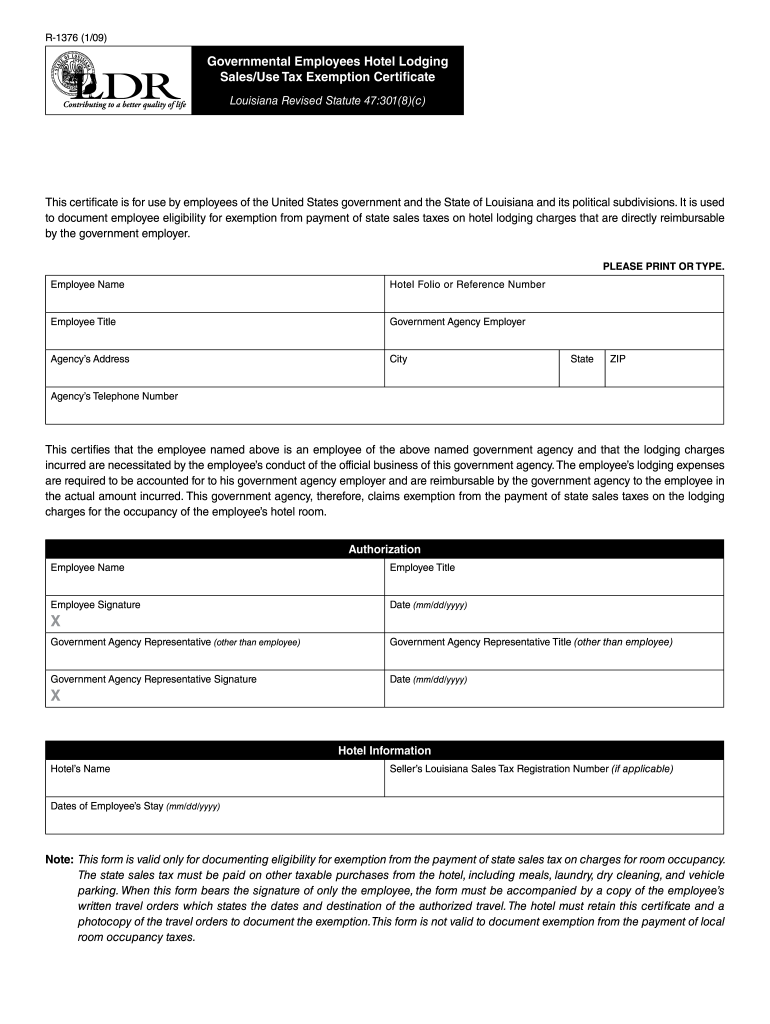

When seeking a income income tax exemption, a legitimate certification of exemption is essential. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A concrete personalized product or service is reported to be in their principal use when it is employed for at least 50% of times. A revenue tax exemption qualification must be offered to the seller with the buyer of the exempt good or services. The seller is mainly responsible for delivering proof.

By submitting Form ST-12, a firm can request a tax exemption certificate. In order to withdraw it if the company is no longer eligible for the sales tax exemption, the seller is required to give the vendors the form. The utilization of exemption use accreditation is controlled by Massachusetts Control (830 CMR 64H.8.1). If an exemption certificate is knowingly misused, criminal consequences may apply. An organization could deal with equally civil and criminal charges for intentionally busting this guideline.

The certificate’s five-calendar year expiration time

Nearly all folks are not aware that qualifications expire following 5 years. Simply because they haven’t been utilized inside that point, these are no more probably going to be reputable. If you want to continue using it, you must obtain a new one, in truth, it’s typical for a card or certificate to expire for more than ten years; therefore. The good news is that you are protected from this circumstance by the law.

Whenever your qualification is because of end, SSL certification providers give notices for their syndication databases. The issue is that when your certificate comes up for renewal, your Point-of-Contact might not be available. In fact, as soon as the certification expires, you could possibly get yourself a campaign or get fired. Luckily, through the use of these methods, you could possibly avoid this predicament. You could expand the life span of your own SSL certificate by using these simple suggestions.