Ohio State Housing Exemption Form 2024 – Being income tax-exempt when selling goods or services, you need to send a Status Exemption Kind. There are other ways to get this form, but applying online is the most popular one. If you accomplish’t know what to glimpse for, the procedure can be confusing. Beneath are one of the standards for any qualification, together with a few images. To get started properly filling out the shape, ensure you are aware about just what it calls for. Ohio State Housing Exemption Form 2024.

savings in income taxation

A certificate exempting an organization from remitting and collecting income fees is known as a product sales income tax exemption qualification. For some kinds of purchases, including individuals produced by the federal government or nonprofit businesses, exemption accreditations are essential. Vendors are still required to maintain their exemption documents, though sales tax is not applied to nontaxable items. Some goods are excluded from revenue taxation, hence well before publishing a product sales taxes, you need to verify that your particular buy is exempt.

In accordance with the form of residence distributed, some states have very diverse revenue tax exemptions. The vast majority of claims respect some merchandise as demands and offer exemptions in accordance with the product. This stuff consist of things likeclothes and food, and prescribed drugs. Suggests that do not completely exempt specific goods normally have reduced taxation prices. Continue looking at to learn much better regarding your state’s income tax exemptions. Here are some useful information and facts to be of assistance be sure you don’t lose out on useful taxation advantages.

Requirements

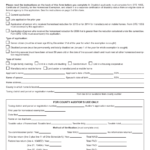

You will find specific needs to fill in your express exemption form, whether or not you’re offering an item online or perhaps in your real retailer. The exemption develop is provided by the Vermont Office of Income taxes. This form must besigned and completed, and applied just for the stipulated cause. More promoting information and facts may be needed in the develop to indicate the property’s exemption. This form may be satisfactory in more than one authority according to the express.

You need to send distinct forms when requesting an exemption, such as an invoice plus a product sales slide. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. Furthermore, you’ll require a current Certificate of Expert. If you sell to numerous states, these documents may be able to save you from having to pay sales tax. When the documents continues to be posted, you will end up qualified to prevent spending income taxation.

Cases

Types of express exemption forms are necessary for small businesses who attempt to stay away from spending revenue taxation. Numerous purchases can be produced using these kinds of paper. They all call for the same fundamental data, even though there are several exemption certificates. No from the exemption, this business operator should keep an up-to-date official document. Types of state exemption types are displayed listed below. Continue reading for additional details on them. You power be shocked at how simple it is to apply them to spend less!

The transaction of merchandise to the public for no-commercial motives is just one sort of express taxes exemption. This taxation break is supposed to advertise both common well being plus a particular business. A factory, as an example, could be excluded from spending income taxation on items used to make your completed product. This could pertain to the tools and machines the producer utilizes to create the best. These transactions will enable the company to avoid paying out revenue taxation.

Conditions to obtain a certificate

In order to get a certificate of state tax exemption, an organization must complete a tax exemption form. An school or governmental body which is exempt from sales income tax should supply the details about the form. Portion 2 of your kind needs to be filled in by a 501(c)(3) thing or through the federal government. In order to conduct business, additionally, it must use the goods or services it has purchased. This qualification is at the mercy of restricted limitations, and taking advantage of it poorly can lead to its cancellation.

There are various forms of certifications which can be used to have a sales tax exemption. Some are accepted with an online merchant and released electronically. Every single status has its own pair of policies for obtaining these files. If you are selling taxable property in New York, in general, a valid Certificate of Authority is required. A certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax, however.

In order to acquire an exemption certificat, criteria to meete

You need to also take into account the distinct demands for a particular business when seeking the suitable status tax price. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. However, if a company does not have a nexus with a state, several states do not compel them to pay sales tax. Within this circumstance, the company is needed to obtain an exemption certificate from your condition where they carry out enterprise.

A creating contractor also can get creating supplies for any undertaking for the taxation-exempt company utilizing an exemption official document. In order to obtain a copy of an exemption certificate, the General Contractor must submit an application for a trade name and license. Before hiring subcontractors, a building contractor must have the certificate. The state’s Assistant of State’s Organization Center is when the service provider must also send an application for any buy and sell brand certification. Construction agreements with taxation-exempt organizations’ exemption certifications, as well as the renewal and enrollment of buy and sell brands, are managed through the Secretary of Status Company Centre.