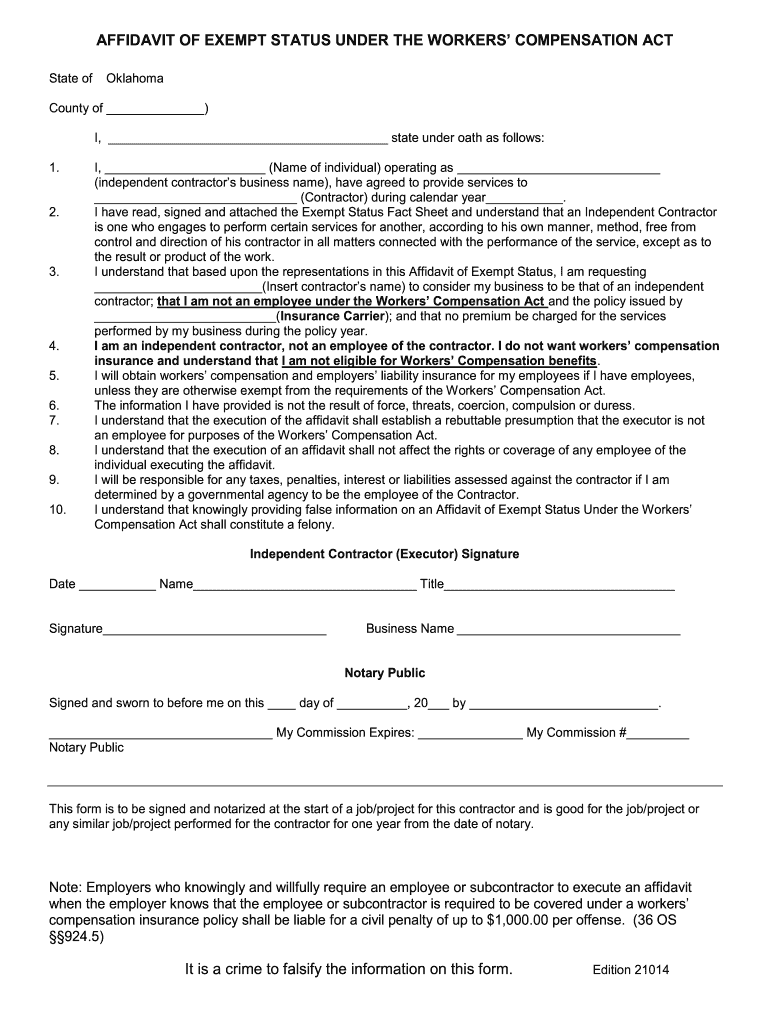

State Of Oklahoma Workers Compensation Exemption Form – To be taxation-exempt while offering services or goods, you should send a Status Exemption Develop. Applying online is the most popular one, even though there are other ways to get this form. If you accomplish’t know what to glimpse for, the procedure can be confusing. Beneath are some of the prerequisites to get a certification, together with a couple of illustrations. To start appropriately filling out the shape, make sure you are aware of just what it demands. State Of Oklahoma Workers Compensation Exemption Form.

reductions in product sales taxes

A official document exempting a business from remitting and collecting product sales income taxes is actually a income taxation exemption certificate. For a few sorts of purchases, such as individuals created by the federal government or charity organizations, exemption accreditations are needed. Vendors are still required to maintain their exemption documents, though sales tax is not applied to nontaxable items. Some goods are excluded from product sales income tax, therefore well before sending a product sales tax return, you must confirm that your purchase is exempt.

Based on the sort of property offered, some claims have rather various income tax exemptions. The majority of claims regard some goods as needs and allow exemptions in accordance with the piece. These things involve stuff likefood and clothes, and medications. Suggests which do not totally exempt certain items most often have decrease income tax prices. Curriculum vitae reading through to determine much better relating to your state’s income taxes exemptions. Below are a few helpful information to help you out be sure to don’t miss out on beneficial taxation rewards.

Requirements

You will find specific should fill out your express exemption form, regardless if you’re offering a product online or even in your actual retail store. The exemption form is provided from the Vermont Section of Taxation. This form needs to becompleted and signed, and applied just for the given cause. Additional supporting information may be required in the form to demonstrate the property’s exemption. This kind could be suitable in multiple legal system depending on the state.

You have to send distinct forms when requesting an exemption, including an invoice plus a revenue fall. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. Moreover, you’ll need a present Official document of Authority. These documents may be able to save you from having to pay sales tax if you sell to numerous states. After the forms is sent in, you may be qualified for avoid spending revenue taxes.

Cases

Instances of condition exemption varieties are very important for small enterprises who seek to prevent paying out revenue tax. Quite a few purchases can be made using this type of pieces of paper. They all call for the same fundamental data, even though there are several exemption certificates. No of the exemption, the company proprietor need to keep an up-to-date certification. Samples of status exemption varieties are demonstrated beneath. Continue reading for additional details on them. You energy be shocked at how effortless it is to try using them to spend less!

The transaction of products to the general public for low-industrial motives is certainly one form of status income tax exemption. This taxation crack is designed to promote the common welfare as well as a distinct industry. A manufacturer, as an illustration, could possibly be excluded from having to pay revenue tax on supplies used to make the completed product. This would pertain to the machines and tools the company uses to produce the great. These buys will let the company to avoid spending income taxation.

Situations to have a certificate

An organization must complete a tax exemption form in order to get a certificate of state tax exemption. An organization or governmental entire body that is exempt from income taxes need to provide the details in the type. Component 2 in the develop needs to be filled out from a 501(c)(3) enterprise or through the authorities. In order to conduct business, additionally, it must use the goods or services it has purchased. This certification is susceptible to tight constraints, and using it improperly could lead to its cancellation.

There are various forms of accreditation that you can use to obtain a income taxation exemption. Some are approved in an on the internet retailer and given in electronic format. Every state has its own list of policies for getting these documents. In general, a valid Certificate of Authority is required if you are selling taxable property in New York. However, a certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax.

In order to acquire an exemption certificat, criteria to meete

You need to also consider the certain needs for the company when picking out the perfect status taxation level. For instance, a company selling widgets may not be required to collect sales tax in Florida, but they must in order to avoid having to do so. Several states do not compel them to pay sales tax if a company does not have a nexus with a state. In this particular circumstance, the company is needed to get an exemption qualification from the condition in which they conduct company.

A building licensed contractor can also acquire developing products for a undertaking for any taxes-exempt company utilizing an exemption official document. The General Contractor must submit an application for a trade name and license in order to obtain a copy of an exemption certificate. A building contractor must have the certificate, before hiring subcontractors. The state’s Assistant of State’s Organization Heart is where the service provider also needs to distribute a software to get a business brand permit. Building commitments with income tax-exempt organizations’ exemption accreditation, as well as the revival and registration of business titles, are taken care of through the Secretary of Express Enterprise Heart.