Travis County Homestead Exemption Form – How must a region exemption develop be completed? You will find a occasional stuff you need to know prior to starting. Certain requirements for implementing as well as the due dates are described in this post. To ensure the process goes as smoothly as possible, keep these suggestions in mind if you’re thinking about submitting an exemption application. The financial savings you’ll recognize after you do will astound you. While guaranteeing your state receives much more govt financing, you’ll be capable of keep more money in the bank. Travis County Homestead Exemption Form.

Obtaining Area Exemptions

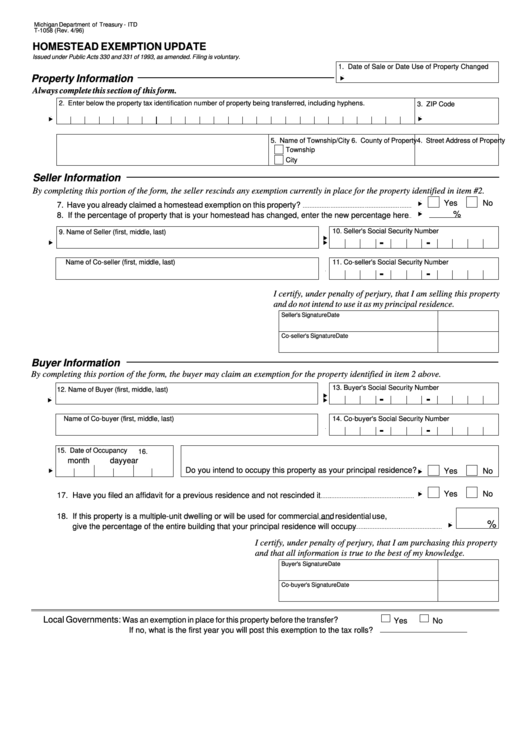

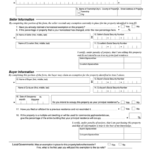

In order to be granted an exemption for your property, you must first submit an Application for County Exemptions. Six replicates with this kind has to be finished in its entirety. It is advised that you do so as soon as feasible, even though your application can be submitted at any time of the year. This will likely assure that you can get the necessary exemption. You should be aware that any demanding authority could tournament your exemption. It’s crucial to adhere to all filing dates, as a result.

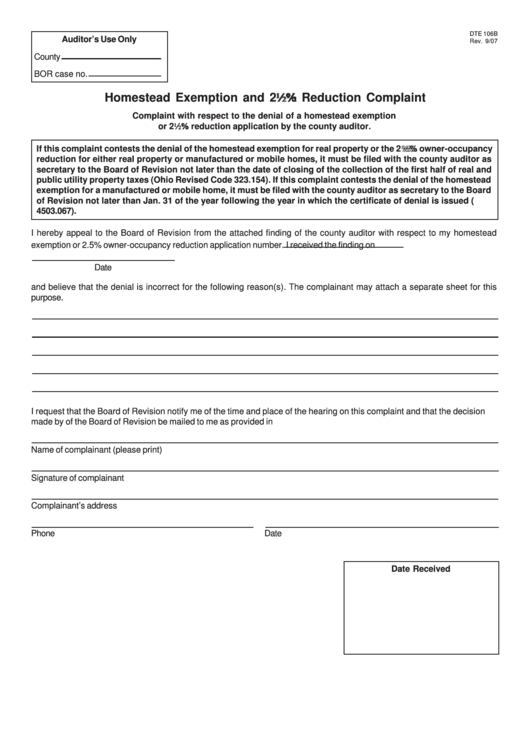

You should charm the denial of the exemption. This attractiveness has a 30-working day filing due date. You should submit an entice the significance Modification Board right after simply being denied. You need to also include any helping documents for your declare. In the seeing and hearing, the home Appraiser is likewise existing. You need to document a lawsuit in circuit judge once the VAB regulations in your appeal. There exists a $15 declaring charge.

Problems for using

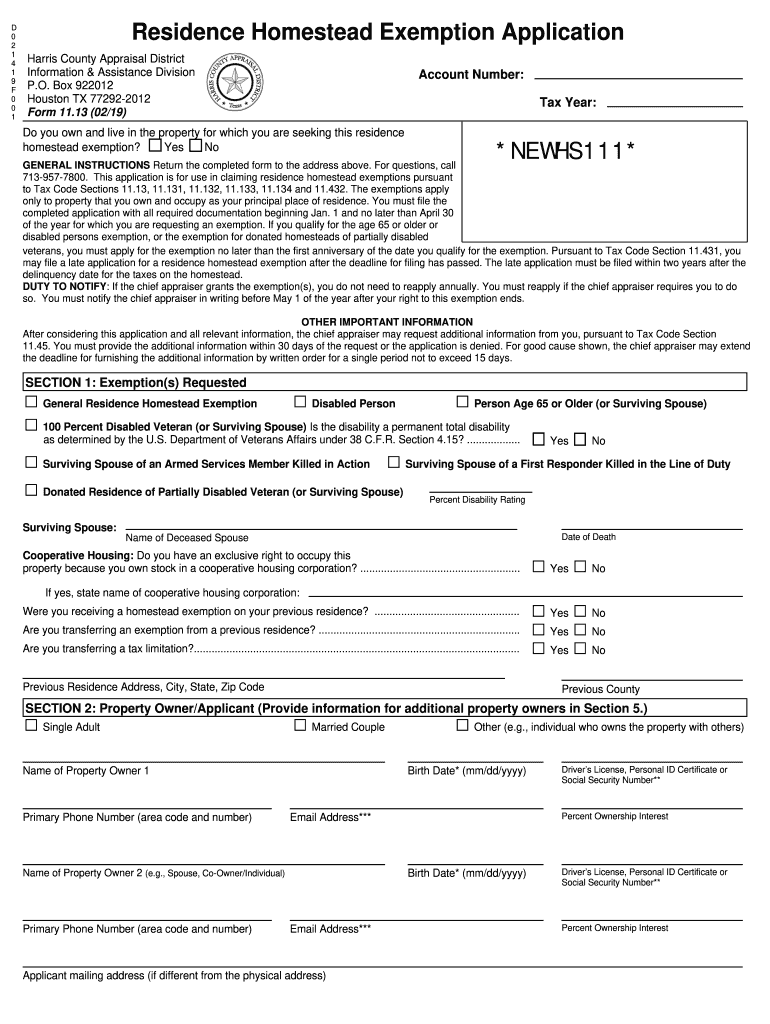

Before submitting the application, review the eligibility conditions first. If relevant, the numbers of any spouses, all candidates are required to submit their Social Security Numbers as well as. All applicants also have to show management paperwork, for instance a reported deed or a taxation expenses from Lee Region. A copy of the trust documentation and document proving your authority to make decisions for the trust are required if you own the property through a trust. Any trustees you might have in the residence must also signal the application within their potential as trustee.

You have to make a certain amount of money to qualify for an exemption. You can qualify for a homestead exemption if your household has a high income. Homeowners who meet the requirements can receive homestead exemptions, but you must be 62 years old or older to be eligible. Home owners 62 years of yrs and more aged will also be exempt from some additional fees. If you are eligible for one of these programs, you might not be required to pay any property taxes.

Circumstances for processing

Learning the submitting standards is crucial when seeking a homestead exemption. According to California law, homeowners who meet the qualifications might earn a $7,000 reduction in their assessed worth. The house must have been the owner’s primary residence as of the lien date in order to qualify. Homeowners need complete the BOE-266 form, which can be obtained from the county assessor’s office, in order to file. First-time candidates can submit the form whenever they become eligible, but no later than February 15; the form must only be submitted once.

You have to personal the house and be 65 years old or more mature to qualify for the Around 65 exemption. The only owner or occupant of the house must be you. The property need to function as your primary residence. You may distribute a software at any moment when you convert 65. You need to also existing documents of the age and residency. To show your eligibility, you have to have a status-granted ID. If you have all the necessary paperwork on hand, the application is only accepted.

File-by dates

Your property must fulfill certain requirements in order to be qualified for a tax relief. Most areas have a due date by which software for tax exemptions has to be presented. Make sure you are aware of the deadline before submitting if you are filing on someone else’s behalf because you will need to provide evidence that they will not be using the property. Such as owning a home for a disabled person, many counties can grant you an additional tax relief, if you fulfill specific requirements. Requesting a tax exemption involves filling out documentation and paying a charge, typically. However, if you’re working with a tax expert, you can submit an exemption form on your own to request a tax reduction.

Candidates should confirm that they possess a valid Texas driver’s license and a DPS identification card, before submitting an application. Moreover, they have to verify how the street address on their Identification and also the one on his or her program are the same. If you’re unsure whether your home qualifies for an exemption, you can contact the Fort Bend Central Appraisal District to learn more about filing requirements. You need to remember that the May possibly fifteenth time frame has gone by for posting an enterprise individual house kind.

accomplishing the shape

Filling in the county exemption form might be challenging, whether or not you’re trying to find a home exemption or a business exemption. You must first choose the appropriate exemption type for you in order to begin. After that, ascertain the income tax years for which you are skilled for that exemption. If you don’t fulfill all of these standards, your application will probably be denied or not taken into consideration.

Even if they don’t live in the property, the majority of taxpayers are required to submit an application to their assessor in order to claim an exemption. Property owned by the state of Minnesota doesn’t need to, though others are required to file every three years. You may occasionally be asked to complete a distinct software. It is best to get guidance out of your county auditor’s office in these situations.