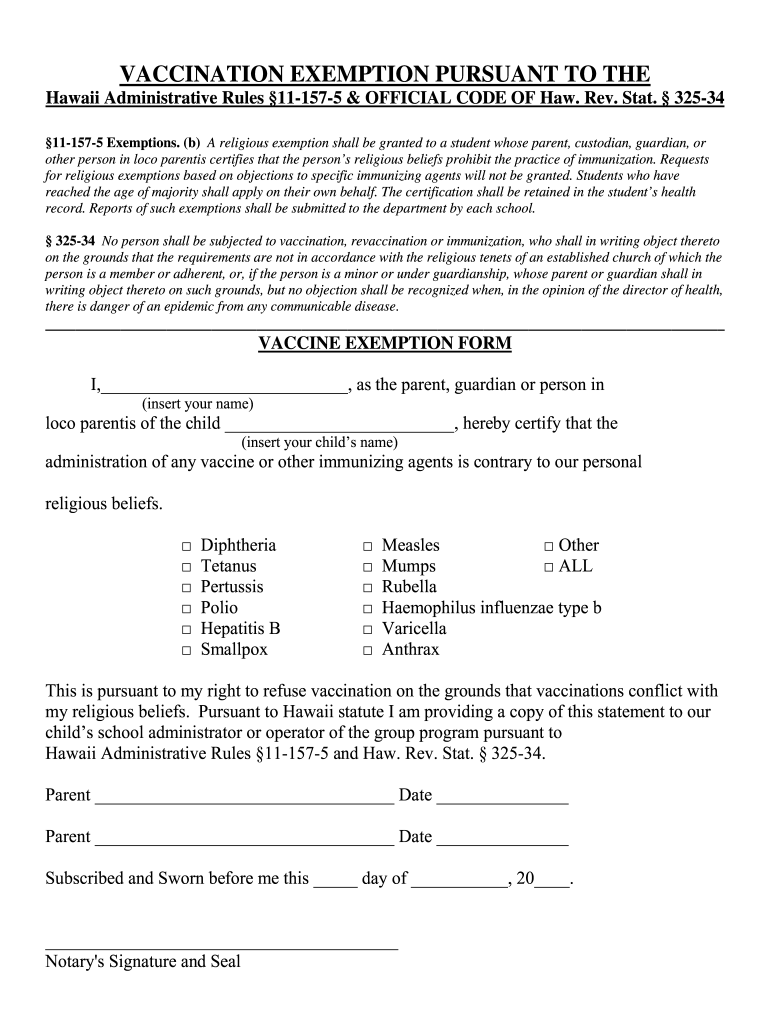

Virginia State Vaccine Exemption Form – To be income tax-exempt whilst selling services or goods, you need to send a Express Exemption Kind. Applying online is the most popular one, even though there are other ways to get this form. The procedure can be confusing if you accomplish’t know what to glimpse for. Under are among the standards for a official document, in addition to a couple of drawings. To start correctly filling in the form, ensure you are aware of exactly what it calls for. Virginia State Vaccine Exemption Form.

reductions in sales taxes

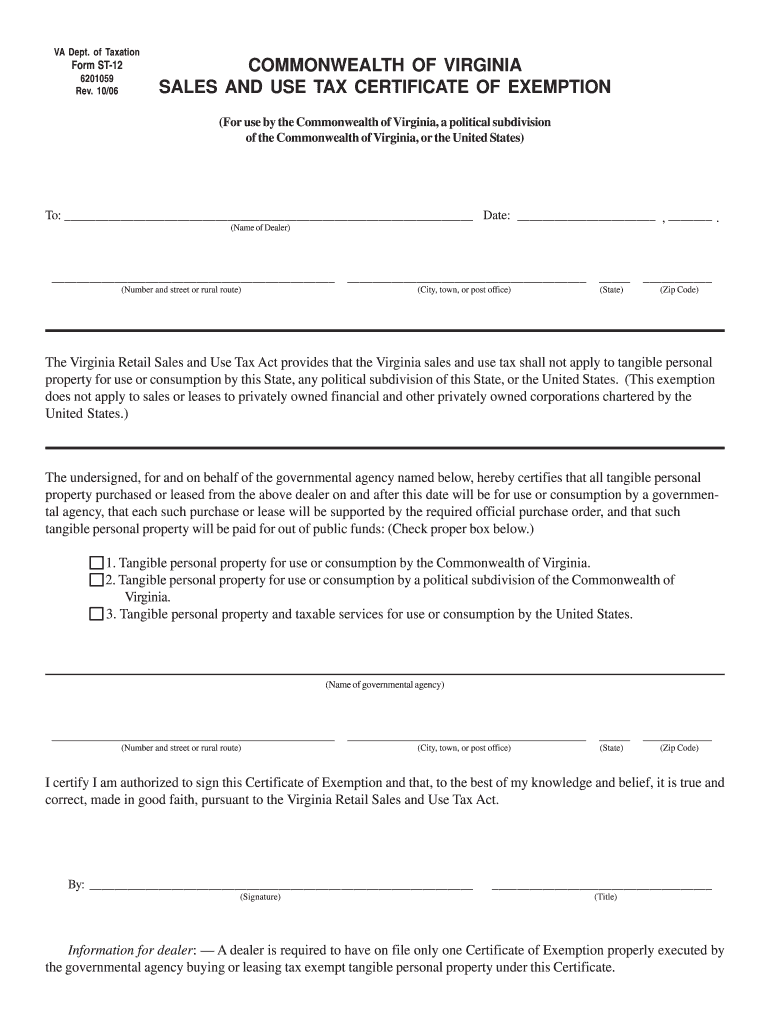

A qualification exempting a business from remitting and collecting product sales taxation is regarded as a revenue taxation exemption qualification. For several forms of transactions, such as all those manufactured by the us government or not-for-profit agencies, exemption certifications are essential. Sales tax is not applied to nontaxable items, although vendors are still required to maintain their exemption documents. Some goods are excluded from product sales taxation, hence just before submitting a income taxes, you need to affirm that the purchase is exempt.

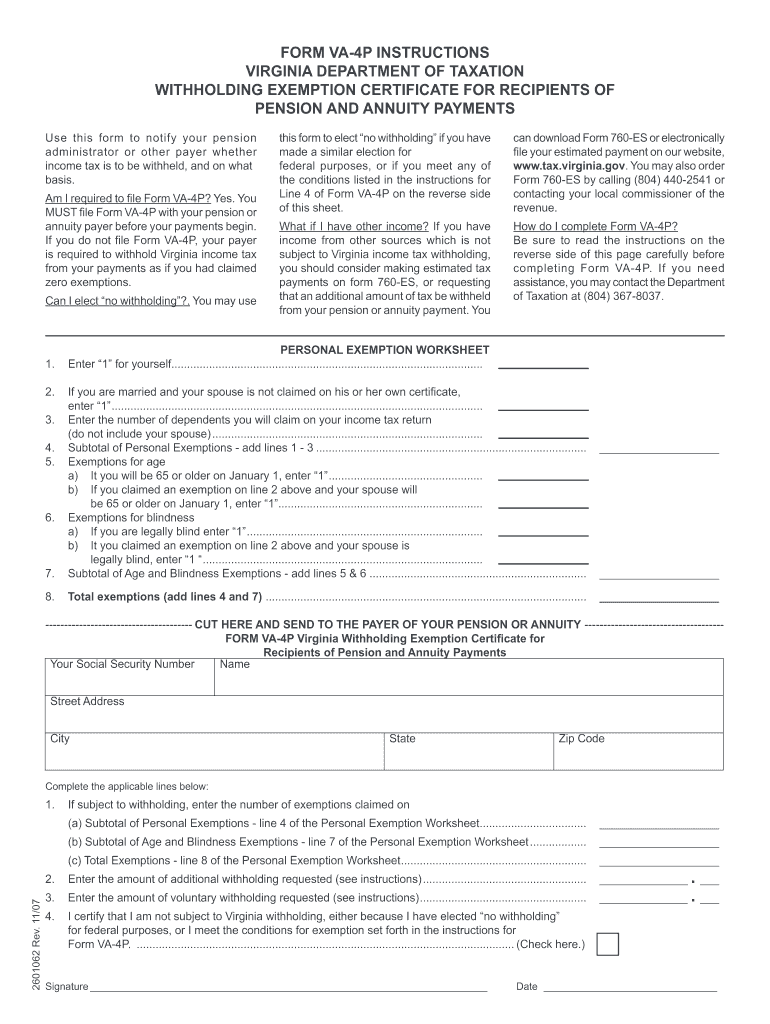

Based on the type of residence offered, some states have quite diverse revenue taxes exemptions. Virtually all says respect some items as demands and give exemptions in line with the object. These things consist of stuff likefood and clothes, and prescription medications. Says that do not completely exempt certain merchandise typically have reduced taxes prices. Continue reading through to find out better concerning your state’s income taxation exemptions. Here are several helpful information to help you make sure you don’t lose out on beneficial taxation advantages.

Requirements

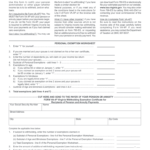

There are actually distinct must submit your condition exemption develop, whether or not you’re marketing an item online or in your true store. The exemption develop is provided through the Vermont Office of Taxes. This form should becompleted and signed, and used only for the specific reason. Further helping information may be needed in the form to show the property’s exemption. This kind might be suitable in multiple jurisdiction according to the state.

You need to publish specific documents when requesting an exemption, which include an invoice along with a sales move. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. Additionally, you’ll require a present Certification of Expert. If you sell to numerous states, these documents may be able to save you from having to pay sales tax. When the forms has become submitted, you will certainly be qualified for steer clear of paying sales taxes.

Good examples

Instances of state exemption types are very important for small businesses who aim to stay away from spending income taxes. Numerous buys can be created using this kind of papers. There are several exemption certificates, but they all call for the same fundamental data. No of your exemption, the business proprietor must keep an updated certification. Instances of express exemption forms are proven below. Read more to understand more about them. You potential be amazed at how easy it is to apply them to spend less!

The transaction of commodities to most people for non-industrial reasons is just one type of express taxation exemption. This taxation bust is meant to market both the standard welfare as well as a distinct industry. A manufacturer, as an example, might be excluded from having to pay income income tax on supplies utilized to make the concluded product or service. This will pertain to the tools and machines the manufacturer employs to generate the best. These transactions will enable the company to prevent paying out product sales income taxes.

Circumstances to get a qualification

An organization must complete a tax exemption form in order to get a certificate of state tax exemption. An organization or governmental body that is certainly exempt from sales tax must provide the information on the type. Aspect 2 from the form needs to be filled out by way of a 501(c)(3) organization or by the govt. Additionally, it must use the goods or services it has purchased in order to conduct business. This certificate is at the mercy of limited restrictions, and making use of it improperly might lead to its cancellation.

There are several types of certifications which you can use to get a income income tax exemption. Some are approved with an online merchant and issued in electronic format. Every express possesses its own list of policies for receiving these files. If you are selling taxable property in New York, in general, a valid Certificate of Authority is required. However, a certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax.

In order to acquire an exemption certificat, criteria to meete

One should also take into account the particular needs for the organization when picking out the appropriate state tax price. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. However, if a company does not have a nexus with a state, several states do not compel them to pay sales tax. In this case, the corporation is needed to obtain an exemption official document from the condition where they conduct business.

A creating contractor can also buy constructing items for the venture for the tax-exempt business employing an exemption certification. The General Contractor must submit an application for a trade license and name in order to obtain a copy of an exemption certificate. A building contractor must have the certificate, before hiring subcontractors. The state’s Secretary of State’s Enterprise Centre is how the licensed contractor should also send an application to get a business label certification. Design contracts with tax-exempt organizations’ exemption certificates, plus the revival and registration of industry titles, are dealt with by the Secretary of Status Company Heart.